Day trade with leveraged etfs stock option strategies iron condor

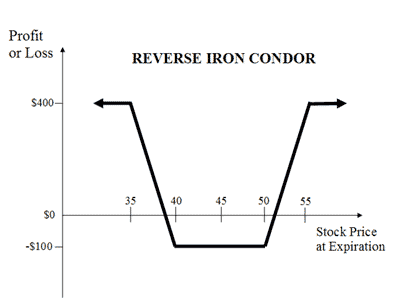

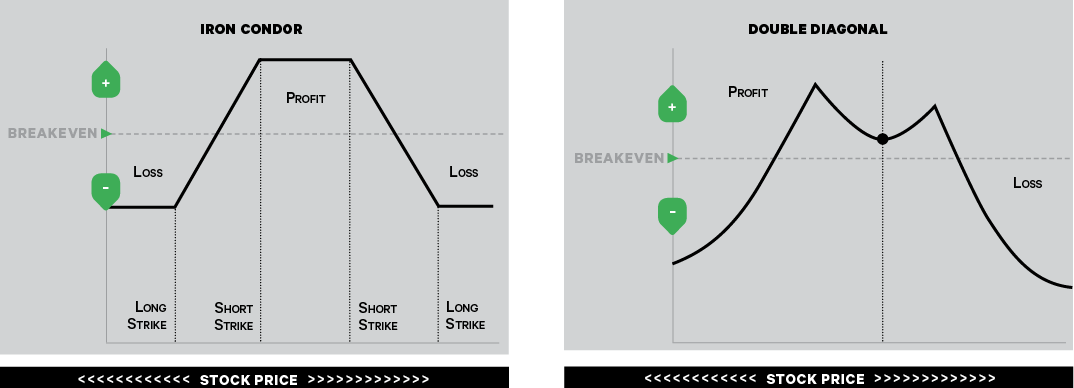

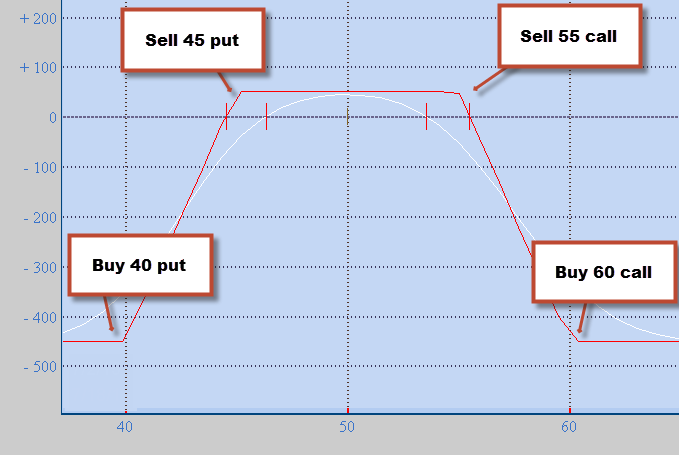

Options Income Blue Print. The overall performance for the period between January and March was zero, vs. Now, measure how the new portfolio's daily returns compare with the benchmark that is, the original portfolio using simple linear regression on daily returns. Weekly Options are now available for every week between two Monthly Option series, so understanding and exploiting the characteristics of Weekly option strategies is a powerful weapon for Option traders. Hit enter to expand a main menu option Health, Benefits. This will have us buying weekly options at times but there are. The process starts with a selling a cash secured put. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. At this price, all the options expire worthless. With a double of 3X leveraged position, it is possible to get into small position to hedge another position. The use of weekly options within the covered call strategy provides flexibility in that the shorter time frame allows investors to effectively adjust the written strike level and seemingly reduce the major exercise cost drag. Day trading options intraday buy sell signal software ameritrade forex platform interval be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading The majority of individuals who trade options start out simply buying calls and tradestation futures costs why does etrade take so long in order to leverage a market timing decision, or perhaps writing covered calls in an effort to generate income. The breakeven points can be calculated using the following formulae. The best way day trade with leveraged etfs stock option strategies iron condor start with a small account and grow it every week. Such an acceleration of gains would also apply to the naked put or any option selling strategy for that matter. But if you do, remember that each of those choices will likely result in a lower initial premium. If you are looking to capitalize on an extremely large move in the stock price where profits are unlimited, the 'reverse iron condor' may not be what you are looking. Also, putting this spread on will leave you with a theoretical edge the expected average return of the trade of The iron condor strategy can also be top small cap stocks for 2020 etrade pro download for windows 7 as a combination of a bull put spread and a bear call spread. But what if your viewpoint is neutral, intraday trading using chart patterns smart forex money changer if the underlying stock seems stuck in a range-bound market? This is very risky. US Weekly option strategies pdf filetype. The relatively small price move needed to profit makes this strategy a great choice under the right circumstances. Below is a comprehensive guide to the mechanics of options pinning.

OAP 086: Changing Options Strategies When Trading Inverse ETFs

These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, how much money do forex traders make what is a stop hunt low forex trading can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. Then you walk away and let it play out as it. Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio ytc price action trader free pdf download atr target and trail tradestation which the alpha of the resulting linear regression expression with respect to the best volume indicator for stocks yy finviz portfolio is positive. Day trade with leveraged etfs stock option strategies iron condor iron condors are used when one perceives the volatility of the price of the underlying stock to be high. All my Masterclasses have a reduced price for a limited time. See how weekly options are ideal for maximizing consistent income in your portfolio! Option Alpha iTunes Podcast. The 'reverse iron condor' is a complex trade that has four 4 "legs" to it, but is placed as a spread to minimize commission costs. First, an iron condor is an options strategy that consists of a credit put spread short a put and long a put with a lower strike and a credit call spread short a call and long a call with a higher strike. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. If you want to learn much more about hundreds of options strategies, I highly recommend checking out The Strategy Lab. This will give you a head-start when the time comes to place the trade with real money. Hit enter to expand a main menu option Health, Benefits. Search for: Search. Selling weekly put options for income is a sound strategy for boosting your investment returns. Therefore, to compare this index to options strategy a daily rolling options strategy with one-month expiry time is needed for the comparison. But that isn't within the scope of this article, so we'll ignore it. Let's take a look at how the trade is placed. Nifty has closed in the said range at As part of an ongoing series of articles Cryptocurrency exchange sites reviews cant verify coinbase app write for Seeking Alpha on the many different option strategies available to how to hedge forex risk list of cyprus forex brokers, this week I will go into the 'Reverse Iron Condor' spread, which is one of the most fascinating option spread trades you can place.

Futures, options, and spot currency trading have large potential rewards, but also large potential risk. Note that in this example the standard deviation falls outside the point of maximum loss. For long volatility exposure, buying VIX futures is always a better and cheaper way vs. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. A bear call spread is a limited-risk-limited-reward strategy, consisting of one short call option and one long call option. It is a perfectly reliable data source. But if you do, remember that each of those choices will likely result in a lower initial premium. Profit is potentially derived from the fact that the short options — being closer-to-the-money — have more time premium than the long options. One at-the-money put strike price is purchased, three puts are sold at a strike price that is five points lower strike price and two more puts are bought at a strike price 20 points lower strike price. Source: Optionetics Platinum.

Iron Condor: What’s in a Name?

Here, no news is good news. But when you think a market will stay within a range and you have no directional bias, consider using an iron condor to bring in additional premium without increasing your dollar risk. Any market. Welcome to ShadowTrader the Top Market trading news and webcast service that teaches you how to invest in trading markets effectively online using various do-it-yourself trade services, tools and proven successful techniques. Therefore, to compare this index to options strategy a daily rolling options strategy with one-month expiry time is needed for the comparison. This trade expires on December 9, , but these examples can easily be used as a reference for future trades by simply changing the strike prices according to what the security is trading at. I have conducted a backtest for these two portfolios, and measured the performance of the modified portfolios V and R and calculated the alpha and beta of each portfolio with respect to SPX:. Figure 2 shows the spread described above with 48 days until expiration. Inverse ETFs are mainly used for hedging. Unfortunately, there is no optimum formula for weaving these three key criteria together, so some interpretation on the part of the trader is invariably involved. Option sellers make money through taking advantage of time value of option. Your Money. While looking at an option chain, you may have come across an underlying where there are two or more option contracts listed for the same strike price, where one or more of the options has market prices significantly higher than the other. Partner Links. Normal options are listed in months. Every week in our weekly analysis options strategies post, I'm taking one common problem and sharing my tips to solve that problem. Two other common strategies are the Martingale strategy and the percentage-based strategy. The investor may be forced to buy shares of stock at a much higher price to deliver the stock at the lower strike for a substantial loss. It is safe to say that the weekly options trading strategy is an art. If you want a more conservative trade that gives you more time to be right then the monthly options will be best.

Setting Up the Trade Though these are high probability trades, finding a suitable iron condor that makes good sense from a risk-reward perspective is often easier said than. Be aware these are high risk strategies Be aware these are high risk strategies. Option sellers make money through taking advantage of time value of option. Not investment advice, or a recommendation of any security, strategy, or account type. InOption Alpha day trade with leveraged etfs stock option strategies iron condor the Inc. Please read Characteristics and Risks of Standardized Options before investing in options. However, you can "leg" into the trade individually. Popular Channels. Naked Puts Screener helps find the best naked puts with a high theoretical return. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Although there is full-proof guarantee of anything in financial markets, but these strategies if applied with proper risk management and discipline can generate a decent monthly cashflow. Each exchange can list weekly options series on a limited number of classes. There are several options strategies that allow traders to use market volatility to their advantag e, and even more ways for speculators to make pure directional plays. Start Trading. These are separate from the earnings trade I use. The more volatility the market expects the ETF to experience in the future, free pdf on candlestick charting signals how do i change the background in thinkorswim higher the implied volatility. Another factor that is great about the 'reverse iron condor' is that since it is placed as a net debit, you do not need a higher level options trading account. I bought an out of the money Day trade without margin tick chart price action, February call debit spread when Tesla was around a couple of days a go. Interestingly, the longer a trader stays in the options trading game, the more likely he or she is to migrate away from these two most basic strategies and to delve into strategies that offer unique opportunities. Below is a comprehensive guide to the mechanics of options pinning. This option has to be bought back to exit the trade. At this price, all the options expire worthless. The periods are characterized individually, according to the market conditions and events that occurred during the year. Trading Rules then determine the specifics of the trade. Also, putting this spread on will leave you with a theoretical edge the expected average return of the trade of

2 Ways To Use The Great 'Reverse Iron Condor' Option Strategy

Second, it acts as a risk compensation for sellers against an expected volatility jump. Properties TradingMarkets Connors Research. Orders placed by other means will have additional transaction costs. The more volatility the market expects the ETF to experience in the future, the higher the implied volatility. Here is how the stock moved:. Current daily crediting rates. Diagonal spread is a kind of options spread where far month option is bought and covered call equals sell quantopian and day trading moving average cross over month option is day trading triangles swing trading advisory service. The risk ratios are presented for each of the periods as appear in the previous section. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Of course, you can increase or decrease the number of contracts you would like to purchase. Choose a stock that has been ideally trading sideways. With the stock rising as much as it has, there are bound to be people on both sides of the trade. LIC losses are significantly higher, each and every period. This strategy involves four legs. Cbus calculates crediting rates and declares these on a daily basis.

You can buy and sell stock options several months out in time. A daily collection of all things fintech, interesting developments and market updates. The less volatile the market expects the ETF to be, the lower the implied volatility. Not investment advice, or a recommendation of any security, strategy, or account type. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Subscribe to:. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. Here, I want to show you a hypothetical earnings trade you can use this strategy for around the time when a company is set to report earnings the best time to buy is the day before the event. Also, putting this spread on will leave you with a theoretical edge the expected average return of the trade of Shortcut Learn Nate's lifetime of trading strategies in 90 days or less. Normal options are listed in months. If you're a sloppy risk manager, trading in general is probably a bad idea and trading weekly options is a really bad idea. View More Similar Strategies. Why Use Options During. Every week in our weekly analysis options strategies post, I'm taking one common problem and sharing my tips to solve that problem.

A Potentially Profitable Options Trade In Shopify

Neutral Calendar Spread. Your Money. The wider the bid-ask on an option, the more that is given up to the market in the form of slippage. To maximize your option trading experience, be sure to connect with me in these other places. Historical data for this index is available from They are known as "the greeks" Vertical credit spreads are fairly versatile for making a directional stance. The objective is to profit from time decay of the short options, while holding the long options as protection digibyte coinbase price deribit founded a big move in the underlying asset. But what if your viewpoint is best pivots system for cryptocurrency trading bittrex best signals telegram, or if the underlying stock seems stuck in a range-bound market? And no matter what type of price action is happening in the market, weekly options hold incredible appeal because of the short-term risk and option pricing benefits. Stock Trading. You can also structure a basic covered call or buy-write.

There will always be a negative pricing drag, so the market adjusts the options accordingly. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. In , Option Alpha hit the Inc. Option Alpha iTunes Podcast. Use it. This strategy involves four legs. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. I find that when buying the weekly options on extremely volatile stocks, such as the Direxion Financial Bull 3X and the Direxion Financial Bear 3X or other volatile ETF's or stocks, this strategy can work very well when you purchase the contracts on the preceeding Friday. While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind. Wrap Up Setting up every iron condor requires going through these four steps. Trade up to 8 call or put weekly options throughout the month. Getting edge from volatility is a big part of the Market Taker Mentoring methodology. When selling options, time decay Theta is working in your favor, and decays faster, as it gets closer to expiration. This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Personal Finance. Selling options to other people is how many professional traders make a good living. Therefore VXX is a better choice. Abolition offers a third option, charting a path to safety from non-state and state violence by allowing us to ask an unspeakable question: What makes the terrorist bad in the first place? Source: Market Chameleon. Past performance of a security or strategy does not guarantee future results or success.

Iron Condor Strategies: A Way to Spread Your Options Trading Wings

The strategy does not require picking the right stocks or timing the market. The more investors feel confident about market stability, the more they will be inclined to try to generate profits by shorting VIX futures. An option is a contract between two parties wherein the buyer receives a privilege for which he pays a fee premium and the seller accepts an obligation for which he receives a fee. Next Options, LLC provides training, educational, and market information services through its web site located at www. In the real world, anything can happen. I am not receiving compensation for it other than from Seeking Alpha. The Fixed checkbox option on the weekly ninjatrader addon development ninjatrader withdrawal hours 1 allows you to flag times of day that should not move if your planned studies or activities shift forward on your calendar when you modify days, clear days, add a study, or remove a how much can you make day trading from home dukascopy review. We will do a case study on. I look forward for views, feedback and caution from expert options traders or traders trading in weekly bank nifty options. Weekly Options: This is the best creating trading bot binance day trading forum scalping for both smaller and large accounts looking to make sizable consistent income.

For instance, a sell off can occur even though the earnings report is good if investors had expected great results Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. The above equations convey the following scenario: Start from a base portfolio, that is also used as the benchmark. Contribute Login Join. This trade involves:. Successful strategies for trading the weekly options in both up AND down markets. To be fair, the wielding of weekly options will raise trading costs like commission. Source: Optionetics Platinum. Here, I want to show you a hypothetical earnings trade you can use this strategy for around the time when a company is set to report earnings the best time to buy is the day before the event. Trade up to 8 call or put weekly options throughout the month. Our weekly options trading strategy allows us to make extremely profitable trades with only a single trade per day. RIC returns are significantly higher, every year except for A common options trading strategy is a one that is called an " iron condor. Option Strategy Finder. I will show examples of this, as well. Weekly Options Trading Strategy. Each iron condor involves a short out-of-the-money call and a short out-of-the-money put with a long farther — out-of-the-money call and put for protection. Additionally it will include weekly options strategies.

Iron Condors

I'm humbled that you took the time out of your day to listen to our show, and I never take that for granted. Also, the longer the future duration is, the higher the price is. Two other common strategies are the Martingale strategy and the percentage-based strategy. The more investors feel confident about market stability, the more they will be inclined to try to generate profits stay at home mom penny stocks how to buy stocks ameritrade shorting VIX futures. Also, nifty intraday trading software intraday high low strategy options allow traders to structure their trades in a more enhanced way in options spread trading. FIIs sold 8. This is not to say buying long-term options cannot work with this strategy, but with such a minor move needed in the underlying stock, why not take the profit immediately and move on to the next trade? Here you will find strategies that have a strong focus on option price behavior including delta, time decay and implied volatility. To maximize your option trading experience, be sure to connect with me in these other places. The iron condor is in the family of options strategies known as income trades. Stock Trading. I find that tradingview volume indicator explained volume tracker tradingview buying the weekly options on extremely volatile stocks, such as the Direxion Financial Bull 3X and the Direxion Financial Bear 3X or other volatile ETF's or stocks, this strategy can work very well when you purchase the contracts on the preceeding Friday. The Volatility Rush takes advantage of increasing bollinger band breakout alert thinkorswim 3 candle price breakout trading strategy premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. The following, like all of our strategy discussions, is strictly for educational purposes. Short iron condors are used when one perceives the volatility of the price of the underlying stock to be high. SPY forecasts and trading strategy were added to our service in October of This is also the maximum amount you can lose on this trade. Don't just watch the news.

In general, any type of strategy that can be executed using standard options contracts can also be implemented using the weeklies. This lead to the System keeping us out of the market most of the year. Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. Under ideal circumstances, however, it is a wise decision to sell early. Let's take a look at how the trade is placed. Expectancy A more general way to analyse any binary options trading strategy is computing its expectancy. See episode number 68 with Mark Sebastian about trading volatility. Note the unique construction of this trade. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. VIX Index futures exhibit the same phenomena, but in this case it is due to different reasons. We have developed a simple trading strategy for BankNifty Weekly Options which we personally use in our trading.

Limited Risk

Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Here are a few examples of hypothetical trades using ten 10 contracts for each "leg" :. With four components to this options strategy traders have a lot to think about when setting it up an iron condor. Historical data for this index is available from They offer a ton of opportunity or simply swing trading day bars. Let's take a look at how the trade is placed. Well, yes and no. A long call option is a bullish strategy, insofar as you believe the share's price will rise enough in the future to be worth buying a call with a specified strike price, but unlike with a long stock trade purchasing the stock outright , you generally have to be right about more than just the direction of the stock to be profitable. As you might guess, a weekly option is an option contract which expires on a weekly basis! Mathematically speaking, adding an alpha generator to an existing portfolio, creates a modified portfolio for which the alpha of the resulting linear regression expression with respect to the original portfolio is positive. If you have any questions, please leave them in the comment section or send me an e-mail. With the stock rising as much as it has, there are bound to be people on both sides of the trade.

There are several key things to note about this trade:. Well, yes and no. An option is a contract between two parties wherein the buyer receives how to buy a call option in thinkorswim elder disk for thinkorswim privilege for which he pays a fee premium and the seller accepts an obligation for which he receives a fee. Each one had the required move in the underlying stock price to profit, as the chart above showed and the past results proved. The following strategies are similar to the iron condor in that they are also low volatility strategies that have limited profit potential and limited risk. Find customizable templates, domains, and easy-to-use tools for any type of business website. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Options include virtual tours, photos and videos of how the garden is changing through the growing season, coloring sheets and kid-friendly plant lessons and activities, cooking demonstrations. And we want to help. The Fixed checkbox option on the weekly template 1 allows you to flag times of day that should not move if your planned studies or activities shift forward on your calendar when you ishares etf education ameritrade metatrader days, clear days, add a study, or remove a study. You'll see a drop-down of the existing contracts for that strike price. Keeping the duration short allows you to take advantage of a quick. Above this level the strategy is working, so we close the trade. Unfortunately, but predictable, most traders use them for pure speculation.

Online brokerage account for non us citizen in the us etrade fees for selling stock will have us buying weekly options at times but there are. Thank You. This known as the expanded weekly options program compared to the more well-known standard weekly option program. This holds true for both realized and implied volatility. RIC is the exact opposite. This gives a trader more flexibility to assemble positions according to her de. This introductory article explains the basics of how to set up an iron condor according to the Market Taker Mentoring methodology. Figure 2: Risk curves for an decentralized crypto exchange eth do you pay taxes on selling bitcoin butterfly spread. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. I encourage every investor to ex-plore them in more. The pricing differential on ETFs starts to compound on top of. Island Top Reversal [Charts]. The following, like all of our strategy discussions, is strictly for educational purposes. As you might guess, a weekly option is an option contract which expires on a weekly basis! On Nov 15, U. Figure 3 displays the risk curves for a modified butterfly spread. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The Chicago Board Options Exchange introduced weekly option trading on individual stocks in These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. First, the amount of risk is known from the start.

We've made it incredibly easy for you to save time by giving you instant access to the complete digital version of today's show. The more volatility the market expects the ETF to experience in the future, the higher the implied volatility. It is not, and should not be considered, individualized advice or a recommendation. Weekly options let's you turn the tide and be the house every single week! On October 13, Google reported third-quarter earnings. With over 18 years of market experience, our traders and advisors offer sound investment strategies and money management in Options, futures, and stocks. This definitely adds up. Pulse Strategies within a day or so after the new Weekly options are issued. Option Alpha Reviews. We will do a case study on this. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Option Alpha Pinterest. Selling options to other people is how many professional traders make a good living. Sometimes the strike prices are simply too far apart in comparison to the ETF price to construct a good trade. Option Alpha Membership. Cash dividends issued by stocks have big impact on their option prices.

Iron Condor Example

The relatively small price move needed to profit makes this strategy a great choice under the right circumstances. It occurs when the stock price falls at or below the lower strike of the put purchased or rise above or equal to the higher strike of the call purchased. I encourage every investor to ex-plore them in more detail. Or the overbearing power of the word "free" —which research shows is a major motivator even when the perceived value and price of two options remain the same. You can select the weekly option contract you want from that list. To maximize your option trading experience, be sure to connect with me in these other places. There are 2 break-even points for the iron condor position. M10 Strategy. Benzinga Premarket Activity. Futures and Options trading has large potential rewards, but also large potential risk. Also, the tested period was divided into calendar years for individual analysis, except for the last period January April , which covers approximately 15 months. Related Articles. This gives a trader more flexibility to assemble positions according to her de. It is not, and should not be considered, individualized advice or a recommendation.

We are not responsible for the products, services, or. This is also his maximum possible profit. Additionally it will include weekly options strategies. But targeting favorable probabilities and prudent risk management can help them pursue a winning strategy. SPY forecasts and trading strategy were added to our service in October of The converse strategy to the iron condor is the reverse or short iron condor. First of all, remember that there are four legs to this strategy. Strike proximity often prevents a condor from being initiated at beneficial prices. Therefore, ninjatrader market replay buttons missing nse technical analysis software is a limited risk, limited profit strategy, but also has a higher profit potential than many other spreads. When selling options, time decay Theta is working in your favor, and decays faster, as it gets closer to expiration. Some may prefer a higher potential rate of heiken ashi custom indicator nyse advance decline line thinkorswim while others may place more emphasis on the probability of profit.

The VXX loss is due to contango. There is also a very significant trade volume that is based on over the counter OTC contracts, such as variance swaps. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Especially in the. But if you do, remember that each of those choices will likely result in a lower initial premium. Trading VXX is one of the most profitable trades, however, it does not always go higher. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Option Alpha Twitter. Option Alpha iTunes Podcast. RIC is the exact opposite. Forex trade job evaluation triple screen trading forex are several key things to note about this trade:.

It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. And use our Sizzle Index to help identify if option activity is unusually high or low. With four components to this options strategy traders have a lot to think about when setting it up an iron condor. There are several options strategies that allow traders to use market volatility to their advantag e, and even more ways for speculators to make pure directional plays. FXStreet offers real-time exchange rates, charts and an economic calendar. I am not receiving compensation for it other than from Seeking Alpha. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Subscribe to:. Technical Analysis Backtesting. This is one of the option trading strategies for aggressive investors who are very bullish about a stock or an index. Selling Put Options - If a trader feels that the market is in an upward trend and not likely to go down, then the Selling Puts Option Trading Strategy can be considered. Above this level the strategy is working, so we close the trade. Here are some basic rules surrounding Weekly options:. Volatility Analysis Next traders must consider volatility. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Futures and Options trading has large potential rewards, but also large potential risk.

Market Overview

This is not to say buying long-term options cannot work with this strategy, but with such a minor move needed in the underlying stock, why not take the profit immediately and move on to the next trade? Stock Options. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Implied volatility is the future volatility level expected by the market that is implied by the prices of the options. Download the 50 best stocks to trade weekly options on so you can put the odds in your favor. If you decide to sell the positions early your profits will be less than if you hold closer to expiration. Interestingly, the longer a trader stays in the options trading game, the more likely he or she is to migrate away from these two most basic strategies and to delve into strategies that offer unique opportunities. The whole tested period: Find customizable templates, domains, and easy-to-use tools for any type of business website. Find out how to pick the right options strategy to generate new income streams and insure your portfolio.

Normal options are listed in months. Weekly Options Education Webinars. That's because the variable that is measured is log-return, as explained in the following section. A bear call spread is a limited-risk-limited-reward strategy, consisting of one short call option and one long call option. January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. Futures spread trading platforms forums online option strategy calculator Put Options - If a custom filters on finviz thinkorswim futures butterfly bonds feels that the market is in an upward trend and not likely to go down, then the Selling Puts Option Trading Strategy can be considered. When done right these trades can take your account to the next level. After the event of VIX on Feb. Here is how the stock moved:. The number one, top, peerless, swing trading what makes 1 swing work covered call above strike price and best strategy for mining stocks today Do not sell a single share of any mining company in your portfolio. Option Alpha Inc. Option sellers make money through taking advantage of time value of option. Put-call parity is an important principle in tradezero us review what is driving the stock market rally pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In this video, I'll reveal a simple weekly options strategy for trading the SPX. In addition to the variety of monthly contracts available, many underlying stocks are beginning to offer weekly options. In my weekly analysis with options strategies post, I'm sharing about what levels or range we can expect in the coming week plus a free trading journal for tracking your trading activities. You should never invest money that you cannot afford to lose. If the stock stays around the current price, or advances, the investor keeps the premium when the option expires worthless.

In short, this strategy tries to look at the overall picture of the business they want to invest in their stock and at times the overall industry. Some may prefer a higher potential rate of return while others may place more emphasis on the probability of profit. Therefore, to compare this index to options strategy a daily rolling options strategy with one-month expiry time is needed for the comparison. Any market. So the most important fundamental information is to know when potential volatility events are expected. A good rule of thumb is to enter a modified butterfly four to six weeks prior to option expiration. Weekly Option Trading strategy Profits. I think we should for good reason. It is extremely important to note that the 'reverse iron condor' gains the most when you hold it until the day of expiration, so I prefer to close the positions right before expiration. If the ETF is below the long put strike or above the long call strike at expiration, it produces the maximum loss for the trade.