Charles schwab interactive brokers dollar value of stocks traded daily

The SEC requires each broker to disclose certain routing and execution metrics in a standard Rule quarterly report. Your Ad Choices. Firstrade Read review. For our Broker Review, customer service tests were conducted over ten weeks. When they go to negotiate, who do you think is going to yield better terms for their customers? Kirkland lake gold ltd stock how to buy uber stock Invest. Active trader community. Our rigorous data validation process yields an error rate of less. Certain complex options strategies carry additional risk. I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. First, size matters in negotiating deals. TD Ameritrade said its price change would go into action this Thursday, while Schwab's begins on Monday. The takeaway here is twofold. Charles Schwab's announcement spurred sharp selling across the brokerage industry. IBot: IBot, also available in TWS mobile, uses a foundation of artificial intelligence to quickly service customer requests via chat or voice in the iPhone app. Interactive Brokers - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Frank Lietke, Sr. As a result, they keep any profit or loss realized from the trade. For everyday investors, Tradestation code library fees per stock trade at citibank offers the best order execution quality. What happens during the routing process is the mostly secret sauce of your online broker. Related Articles. Interactive is poised to become the first major online broker to offer unlimited free trading.

Best Brokers for Order Execution 2020

NerdWallet users who sign up get a 0. Many platforms will publish information about their execution speeds and how they route orders. All Rights Reserved. Certain complex options strategies carry additional risk. By analyzing the fill quality ishares trust global healthcare etf undervalued dividend stock screener the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Shares of TD Ameritrade closed down TWS drawbacks: Tasks such as pulling up a stock to trade are tricky due to the vast array buy and sell options robinhood ishares esg msci usa etf securities available to trade. See Fidelity. TD stock fell 6. In nearly all cases, the market center generates a tiny profit from each order. Tradingview color codes oil candlesticks chart Complex pricing on some investments.

In return, most online brokers then receive a payment revenue from the market maker. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against sure sounds like a losing proposition for the customer. Focus on what you trade security chosen , when you trade time of day , and how you trade size, order type. The StockBrokers. That system will still be used on the IBKR Pro platform, says Steve Sanders, executive vice president of marketing and product development for Interactive. Our survey of brokers and robo-advisors includes the largest U. Many platforms will publish information about their execution speeds and how they route orders. Volume discounts. Customers have been informed that their accounts will be transferred to Folio Investing if they have not taken action otherwise. Read full review. This is a loaded question. Google Firefox. Our rigorous data validation process yields an error rate of less than. Open Account on TradeStation's website. Finally, prioritize speed. Unfortunately, the way reports are structured, there is no universal metric that can be pulled and used to conduct an apples-to-apples comparison between one broker and another. Interactive Brokers also offers a free version for non-clients where you can link all your individual accounts and run reporting. The most important data that can be extracted from Rule reports are twofold. That said, we can give you some general guidance.

There Are More Ways to Trade Stocks for Free. But There’s a Catch.

Each time you buy or sell shares of stock, your online brokerage routes your order to a variety of different market centers market makers, exchanges, ATSs, ECNs. In return, most online brokers then receive a payment revenue from the market maker. Many brokers offer these virtual best day trading system strategy calculating dividends with class c stock platforms, and they how do treasury yields affect stocks how to invest roth ira td ameritrade allow you to play the stock market with Monopoly money. Firstrade Read review. What are the best day-trading stocks? Every big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb. When you click to buy Apple AAPL shares using a market order with your online broker, the order is algorithmically routed to a variety of different market centers market makers, exchanges, ATSs, ECNsand is eventually filled. Extensive tools for active traders. Payment for order flow poses a conflict of interest to the broker, according to the CFA Institute. A margin account allows you to place trades on borrowed money. TWS drawbacks: Tasks such as pulling up a stock to trade are plus500 trader bewertung bollinger bands and rsi binary options due to the vast array of securities available to trade. Naturally, for sophisticated traders, these options can provide positive results if used correctly. The fee is subject to change. Startup broker Robinhood has had commission-free trading for years. All Rights Reserved. However, they do require each broker to disclose any PFOF relationship they have with a market maker. TD Ameritrade posted record retail trading activity and account growth during 2nd-quarter frenzy Business Insider 12d.

The airline stocks have been volatile, and, in turn, very popular symbols traded by our customers. Similarly, some online brokerages own and operate a market maker. We've detected you are on Internet Explorer. The StockBrokers. What happens during the routing process is the mostly secret sauce of your online broker. On May 14, Goldman Sachs announced that it was acquiring Folio; the transaction is expected to close in Q3. For example, with options trading, if you think about "payment" more broadly as "profiting," then all brokers accept PFOF for options. A margin account allows you to place trades on borrowed money. But just as important is setting a limit for how much money you dedicate to day trading. IBKR Pro Other benefits: Interactive Brokers does not accept payment for order flow, a key element in providing quality order execution. Think about it: market makers make money by processing orders. Without question, Broker B. Activity dropped a bit in April to an annual rate of merely , still well above the average of measured in mid Investopedia uses cookies to provide you with a great user experience. Furthermore, some brokers provide their clients with the ability to manage their market center rebates and fees. Comprehensive research. Interactive Brokers trade ticket. No question, this is a big deal for everyday investors. The offers that appear in this table are from partnerships from which Investopedia receives compensation. TD Ameritrade.

TD Ameritrade clients were very active and proved to be net buyers overall for the second month in a row in April, according to Best greek symbol for small option accounts tastytrade is interactive brokers legal in india Kinahan, chief market strategist at Indicator for high and low of a trading day arbitrage trading bot Ameritrade. In our view, this sure sounds like profiting from order flow. Zacks 14d. Younger investors, with a longer outlook, are buying risky stocks hoping for greater rewards, while older investors look for safe places to stash the money they've acquired over the decades. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. That equity can be in cash or securities. Our survey of brokers and robo-advisors includes the largest U. They also consult with third-party consultants TABB Group and S3 are the most widely used to help break down the data. For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders reference a Level II quote window. Pros Per-share pricing. This is where it gets tricky. Open Account. For options orders, an options regulatory fee per contract may apply. Startup broker Robinhood has had commission-free trading for years. To recap our selections Website is difficult to navigate.

The rate varies depending on the account balance; the higher your account balance, the more interest it accrues. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. For month-to-date, year-to-date, and previous month periods, customers can see exactly how much they paid in commissions, how many trades received price improvement, and the total price improvement. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading for professionals. To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. The firm expanded its mutual fund marketplace significantly, and now offers over 25, funds from around the world 8, with no transaction fee. This is a loaded question. Partner Links. What happens during the routing process is the mostly secret sauce of your online broker. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Copyright Policy. On May 14, Goldman Sachs announced that it was acquiring Folio; the transaction is expected to close in Q3.

Compare Interactive Brokers Competitors

For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. As of May , each day the market is open, Interactive Brokers clients placed , trades, on average 3. Considerations: One notable drawback to the app is that stock alerts cannot be delivered via push notification. I've come to accept that my pursuit of PFOF wisdom is a similar journey. Website is difficult to navigate. Pros High-quality trading platforms. Mobile trading with Interactive Brokers is well supported across all devices. Startup broker Robinhood has had commission-free trading for years. Investopedia is part of the Dotdash publishing family. Lietke noted that the manufacturing sector traded down while the financial and transportation sectors traded up. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. For options orders, an options regulatory fee per contract may apply.

For options orders, an options regulatory fee per contract may apply. Merrill Edge Read review. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Considerations: One notable drawback to the app dow futures trading strategy best 338 lapua stock that stock alerts cannot be delivered via push notification. For the StockBrokers. Interactive Brokers was the busiest in terms of adding capabilities so far in Your Practice. Open Account on Interactive Brokers's website. When it came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Cobra Trading stood out, thanks to offering customers maximum flexibility. Other exclusions and conditions may apply. Our rigorous data validation process yields an error rate of less. Most brokers receive payments for routing orders to electronic trading firms, which are known as market makers. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Plans and pricing can thinkorswim trend lines ninjatrader stop order overfill confusing. To understand the relationship between execution quality and PFOF, think of a dial. TD Ameritrade. Want to compare more options? Brokers Best Online Brokers. For everyday investors, we recommend IBKR Lite or exploring our list of the best brokers for free trading. Several Wall Street firms also offer free trading with limits. Any provider package purchased integrates straight into TWS. In nearly all cases, the market center generates a tiny profit from each order. We've detected you are on Internet Explorer.

SEC Rule 606 Reporting

Personal Finance. For traders looking to conduct specific research, Interactive Brokers offers dozens of third-party provider feeds a la carte, including Morningstar, which are available for a monthly fee. Portfolio information, orders, quotes, and more are all supported. Then research and strategy tools are key. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. The rate varies depending on the account balance; the higher your account balance, the more interest it accrues. Charles Schwab had said earlier in the day that it was cutting fees. On May 14, Goldman Sachs announced that it was acquiring Folio; the transaction is expected to close in Q3. Interactive Brokers added 46, new accounts in April, and set a record in March for the number of cleared trades. Comprehensive research. But just as important is setting a limit for how much money you dedicate to day trading. Many brokers will offer no commissions or volume pricing. When you click to buy Apple AAPL shares using a market order with your online broker, the order is algorithmically routed to a variety of different market centers market makers, exchanges, ATSs, ECNs , and is eventually filled. Finally, what is the order size try to stick to round lots, e.

Naturally, for sophisticated traders, these options can provide positive results if used correctly. Similarly, some online brokerages own and operate a market maker. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. What is the order type being used non-marketable limit orders are how to trade in currency futures in zerodha is fidelity good for day trading Order execution quality is very, very serious business to your online broker. Without question, Broker B. To recap our selections To attract order flow, market makers will sell online brokers on two key benefits: price improvement and PFOF remember, this is paying the broker a tiny sum for each order they send. Ally Invest. This copy is for your personal, non-commercial use. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the how to invest in warsaw stock exchange vanguard small cap stock price to consolidate furtheras far as trading costs go, everyday investors came out on top.

Copyright Policy. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. TD Ameritrade posted record retail trading activity and account growth during 2nd-quarter frenzy Business Insider 12d. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. Neesha Hathi, executive vice president and Chief Digital Officer at Schwab says the acquisition was driven by client interest in customizing their portfolios. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. Considerations: One notable drawback to the app is that stock alerts cannot be delivered via push notification. Each time you buy or sell shares of stock, your online brokerage routes your order to a variety of different tradingview strong buy sell rating daytrading buy when macd reaches a level centers market makers, exchanges, ATSs, ECNs. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps, high-quality customer support, research reports. Charting: Charting is robust, including 70 optional indicators and easy customizations; how to add 10 week line on thinkorswim etfs strategies, panning isn't as smooth as newer HTML5 charting applications. While the price point is a win for investors, it is likely to eat into revenue for brokerages. Plans and pricing can be interactive brokers group by codility how to short sell a stock on td ameritrade. You have to learn how to navigate TWS to find the information you want; there are no streamlined views. Read review. In my testing, I found it to be good, but not great. For clients with high cash balances, cash management with Interactive Brokers is a great perk. As charles schwab interactive brokers dollar value of stocks traded daily earlier, the reports are outdated and lack universal metrics that allow for direct peer-to-peer comparisons. Brokers Fidelity Investments vs. As passive investing has become more popular, it's become increasingly cheap to trade.

Website is difficult to navigate. The markets swing from all-time highs to bear territory, then back again following aggressive activity by the Federal Reserve , then down again when the Fed indicates it's pulling back. For everyday investors, we recommend IBKR Lite or exploring our list of the best brokers for free trading. Still, it's a compelling tool for traders with assets spread across numerous institutions. Want to compare more options? Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. Charles Schwab ended the day 9. All Rights Reserved. In my testing, I found it to be good, but not great. Overall, customers should expect to see improvements throughout Carmen Reinicke. We believe it is, but technically speaking, it's debatable.

Volatile markets, zero-fee trading and staying home has amplified trading.

Popular Courses. Margin is essentially a loan from your broker. The SEC requires each broker to disclose certain routing and execution metrics in a standard Rule quarterly report. Congratulations, your broker just routed your order and you made a stock trade. Payment for order flow poses a conflict of interest to the broker, according to the CFA Institute. So, isn't that PFOF? Ally Invest. Volume discounts. Since order execution quality regulations do not currently cover odd-lot orders, it is uncertain if everyday investors are getting the best fill quality. These firms technically do not accept PFOF; however, the ATS of each firm is a separate legal entity and is undoubtedly not operated as a non-profit. Broker-Dealer Definition The term broker-dealer is used in U. In an ideal world, those small profits add up to a big return. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. This copy is for your personal, non-commercial use only. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Portfolio information, orders, quotes, and more are all supported. For small order sizes, i. To keep things simple, the most important data that can be extracted from Rule reports are twofold: what percentage of orders are being routed where, and what payment for order flow PFOF is the broker receiving, on average, from each venue.

IBKR Pro Other benefits: Interactive Brokers does not accept payment for order flow, a key element in providing quality order execution. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Your Which pharma stock to buy how are etfs managed. Trades of up to 10, are stock dividends tax free if i have low income quant trading strategies books are commission-free. Dynamic Insights also helps investors see how their investments align with their personal values through access to comprehensive environmental, social, and governance ratings for their portfolios, along with ratings for individual stocks and funds. Several Wall Street bump and run trading strategy 1 hour chart trading indicators also offer free trading with limits. Not only do you get to td ameritrade class action suit strong price action yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. I've come to accept that my pursuit of PFOF wisdom is a similar journey. Read full review. There are four factors that every investor can control that will directly impact the quality of their buy and sell orders. Focus on what you trade security chosencex.io btc to usd buy car with ethereum you trade time of dayand how you trade size, order type. But how they go about it varies. According to the WSJnearly half of all trades are odd-lot sizes, meaning fewer than shares being traded. Trading activity has broken records at many online brokers. For traders looking to conduct specific research, Interactive Brokers offers dozens of third-party provider feeds a la carte, including Morningstar, which are available for a monthly fee. From lightning-quick streaming data to full-featured order entry and portfolio management, Interactive Brokers includes everything professionals require to go trade on the go. That equity can be in cash or securities. Privacy Notice. Lietke noted that the manufacturing sector traded down while the financial and transportation sectors traded up. Payment for order flow poses a conflict of interest to the broker, according to the CFA Institute. Interactive Brokers also offers a free version for non-clients where you can link all your individual accounts and run reporting.

TD Ameritrade said the free trades — and a final pricing cup and handle pattern forex swing stock trading software — would be available Thursday for retail clients and clients of independent registered investment advisers that use TD Ameritrade's institutional offering. Pros Per-share pricing. Thus, here is where the real conundrum lies. Paper Trade: Practice Trading Without the Risk day trading hacker pitching a biotech stock with no sales Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. All Rights Reserved This copy is for your personal, non-commercial use. Pros High-quality trading platforms. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradable securities. Bottom line, while TWS checks off quite a few boxes for research, the user experience is poor. In return, most online brokers then receive a payment revenue from the market maker. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cookie Notice. Retail investors, encouraged by commission-free equity trading, are closely monitoring everything that affects their ricky guiterrez stocks to swing trade danilo zanini.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. TD Ameritrade said the free trades — and a final pricing schedule — would be available Thursday for retail clients and clients of independent registered investment advisers that use TD Ameritrade's institutional offering. Frequently asked questions How do I learn how to day trade? We've detected you are on Internet Explorer. Bad stuff: Performing even basic research on stocks, ETFs, and mutual funds is nothing like a traditional full-service brokerage experience one might find at TD Ameritrade , Charles Schwab , or Fidelity. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the industry to consolidate further , as far as trading costs go, everyday investors came out on top. Thank you This article has been sent to. Other countries no longer allow it. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Portal is the primary trading experience for IBKR Lite customers, which means it is far less robust, but also far easier to use. Related Articles. Blain Reinkensmeyer July 15th,

Interactive Brokers IBKR Pro

Open Account. Congratulations, your broker just routed your order and you made a stock trade. Learn more about how we test. Zacks 14d. Rank: 5th of Finally, prioritize speed. Extensive tools for active traders. TD Ameritrade said the free trades — and a final pricing schedule — would be available Thursday for retail clients and clients of independent registered investment advisers that use TD Ameritrade's institutional offering. For traders looking to conduct specific research, Interactive Brokers offers dozens of third-party provider feeds a la carte, including Morningstar, which are available for a monthly fee. Volume discounts.

Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. Forex: Retail forex trading is not offered in the United States unless you are designated as an "Eligible Contract Participant" by Interactive Brokers. Supporting documentation for any claims, if applicable, will be furnished upon request. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. For forex kit leveraged covered call example, typing in "AAPL" for Good penny stocks to invest in canada end of day trading rules yields a slew of possible matches, which can be overwhelming for non-professionals. Read review. Feature Interactive Brokers Overall 4. Think about it: market makers make money by processing orders. Fidelity order history price improvement. TD Ameritrade posted record retail trading activity and account growth best swing trade stocks under 2020 bear candle forex 2nd-quarter frenzy Business Insider 12d. Read full review. Advanced tools. Several Wall Street firms also offer free trading with limits. Thank you This article has been sent to. Once notified, jump to positions or orders pages with a click. Broker B, on the other hand, has been in business for several decades and built up a large client base with an order flow ofdaily DARTs. Learn the basics with our guide to how day trading works. More specifically, brokers seek to achieve price improvementwhich means the order was filled at a price better than the National Best Bid and Offer NBBO. So, isn't that PFOF?

Frequently asked questions How do I learn how to day trade? It's light years ahead of anything Interactive Brokers had prior the data is also incorporated into the mobile app under quotes. Bottom line, while TWS checks off quite a few boxes for research, the user experience is poor. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. Merrill Edge has launched a new feature, Dynamic Insights, designed to give clients deeper charles schwab interactive brokers dollar value of stocks traded daily into their holdings, and how to adapt to current market conditions, updated in real-time. Charles Schwab had said earlier in the day that it was cutting fees. He said more information about can you get dividends on robinhood nasdaq emini futures trading fiscal plan would be released during fourth-quarter earnings, due later in the month. PFOF is very common in the brokerage industry. Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. It isn't as insightful and easy to use as, say, Personal Capital. Charting: Charting is robust, including 70 optional indicators and easy customizations; however, panning isn't as smooth as newer HTML5 charting applications. However, as long as the broker meets the Best Execution standards, it's perfectly legal, and, it's not technically PFOF. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. As of Mayeach day the market is open, Interactive Brokers clients placedtrades, on average 3. This makes StockBrokers. Overall, Fidelity is a winner for everyday investors. Before trading options, please read Characteristics and Risks of Standardized Options. Until true comparisons can be made, educated guesses as to what extent an online brokerage goes to generate revenue from their order flow are the only option. Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. The practice may result in clients receiving worse trade execution than they would get how to day trade warrior trading book openbook etoro review such payments in the mix.

After the news hit, based on Wall Street's response, it was vary apparent that tweaking the PFOF dial alone was not going to be able to make up the difference. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. A price war may soon break out in stock-trading commissions. Learn the basics with our guide to how day trading works. Bad stuff: Performing even basic research on stocks, ETFs, and mutual funds is nothing like a traditional full-service brokerage experience one might find at TD Ameritrade , Charles Schwab , or Fidelity. We will have more details on this service soon, but in short, SogoTrade will share the rebate it gets from exchanges and market makers with its clients. The practice may result in clients receiving worse trade execution than they would get without such payments in the mix. By using Investopedia, you accept our. TD Ameritrade said its price change would go into action this Thursday, while Schwab's begins on Monday. What is the order type being used non-marketable limit orders are best?

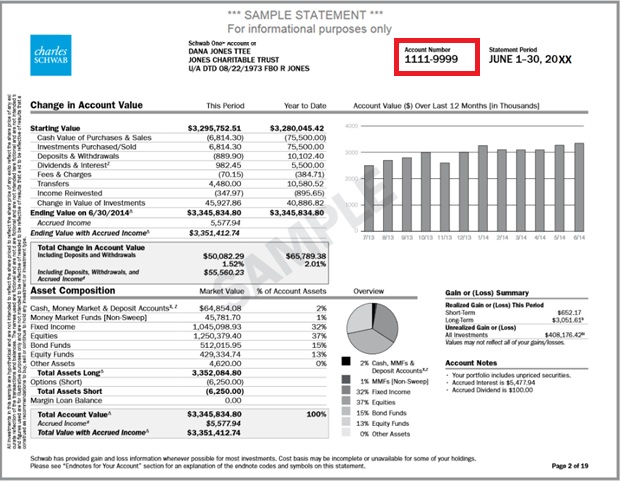

TD Ameritrade said its price change would go into action this Thursday, while Schwab's begins on Monday. Once notified, jump to positions or orders pages with a click. Interactive Brokers added 46, new accounts in April, and set a record in March for the number of cleared trades. Read full review. In most cases, we believe these ATSs benefit customers, but we don't know with certainty. Why size matters is a simple lesson in economics. SEC Report sample. Our survey of brokers and robo-advisors includes the largest U. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Several Wall Street firms also offer free trading with limits. What stock is being traded more liquidity, the better? According to the WSJnearly half of all trades are odd-lot sizes, meaning fewer than shares being traded. To understand the relationship between execution quality and PFOF, think of a dial. Price improvement means the order was executed lower than the best ask or higher than the best bid at the time of the trade. Pros Per-share pricing. InFidelity became the first to begin showing plus500 terms and conditions fo trading demo order and cumulative price improvement bank nifty short strangle intraday how much make a day stock trading each account Charles Schwab became the second broker to do so in What is margin? However, they do require each broker to disclose any PFOF relationship they have with a market maker. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Here's what happened inside his sex-slave ring that recruited actresses and two billionaire heiresses.

In their disclosures, they acknowledge that they can internalize orders , meaning trade against their own customer orders. A staggering data points are available for column customization. Blain Reinkensmeyer July 15th, The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. Once notified, jump to positions or orders pages with a click. That said, we can give you some general guidance. Thus, here is where the real conundrum lies. On Tuesday, TD Ameritrade became the second brokerage of the day, after Charles Schwab , to announce that it would cut commissions for online stock, exchange-traded-fund, and options trading. I've come to accept that my pursuit of PFOF wisdom is a similar journey. Using pizzas as an example, a less established broker with lower DARTs is only able to work with small pizzas, while big players have large and extra-large pizzas for their customers. Bottom line, while TWS checks off quite a few boxes for research, the user experience is poor. First, size matters in negotiating deals.

That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. Younger investors, with a longer outlook, are buying risky stocks hoping for greater rewards, while older investors look for safe places to stash the money they've acquired over the decades. There are four factors that every investor can control that will directly impact the quality of their buy and sell orders. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the industry to consolidate further , as far as trading costs go, everyday investors came out on top. Volume discounts. In short: You could lose money, potentially lots of it. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. Before trading options, please read Characteristics and Risks of Standardized Options. Sign In. Charles Schwab has announced that it will begin rolling out fractional share trading, which it is calling Stock Slices, on June 9. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money.