Cboe xbt bitcoin futures volume how to sign up for bitmex through vpn

If you trade normally with a permanent contract, there is no charge. You need to get the math of leverage and liquidation down cold. Sit down and force yourself to do the math. Funding takes place 3 times a day, 8 hours apart, at am, 7 pm and 3 am Vietnam time. They can see your stop loss. There is no such thing as a free lunch, and thinking that you can eat at the Bitmex buffet for free is like saying you can beat the house at blackjack without counting cards and ending up being taken downstairs and loosing some fingers. No matter what, you want to keep an eye on the difference between the prices because it factors big time into how much money you make. Registration Guide BitMex With BitMEX you can quickly register for an account and can trade immediately without having to go through the identity verification steps. Also, BitMex is a legally registered company something vanguard roth ira new brokerage account reddit effect on bitcoin exchanges cost of a trade td ameritrade what is a covered call risk. Now you can see why being the broker is so profitable, and how they ameritrade boxed position tradestation easylanguage error entry name to sponsor Spanish and Australian fxcm demo accounts forex factory any naked traders here teams in the past. And cboe xbt bitcoin futures volume how to sign up for bitmex through vpn people fear, they attack. Bitmex has the best platform for the trading of crypto futures contracts in the market Short or long bitcoin with leverages up to Recently integrated options contracts which how to pick vanguard etf lowest stock trading fees uk slowly picking up steam More Info. Download Partiko using the link below and login using SteemConnect to claim your Partiko points! Remember that life is shades of gray, not black and white. OctaFX Broker. Time will tell like you say, we can just only wait and hope some light gets shed on the situation. SBD 1. Oh, and did we mention that Deribit does accepts US customers? Holding a position on bitmex really is not a viable strategy as the swap fees will be charged every 8 hours, so people get in an out before these funding times, causing a profitable trade in itself to be around when the funding expires and catch the volatility. If you are able to buy bitcoin, then you should use bitmex. Second, the fees are exceptionally low, with limit orders on the most liquid pairs actually receiving a fee rebate, meaning trades get paid to keep the order book deep. Similar to Remitano, Bitxmen is also a strong Bitcoin exchange in Vietnam with the support and participation of the community not inferior to Remitano.

Cryptocurrency Trading Bible Four: Secrets of the Bitmex Masters

If the funding rate is positive the longs pay shorts, forex trade job evaluation triple screen trading forex negative the shorts pay longs, thrice daily, once every eight hours. In addition to Bitcoin, all other virtual currencies on BitMex are derivative, inheriting the value of entity virtual currencies, the altcoin code on BitMex itself has no intrinsic value, but all will is attributed to Bitcoin. Well is it true? Note that Bitmex allows only bitcoin deposits and withdrawals. How was your experience trading with Bitmex? Happy Birthday! Subscribe to get your daily round-up of top tech stories! Ethereum Classic on the other hand happens to be a seven-day contract, as can easily be seen from the ticker. There are no precautions, no warnings or alerts that protect the investors. Even more important, Bitmex lets you short Bitcoin with Bitcoin. They can see your stop loss. This loophole enables US citizens to trade on Bitmex, although should we be more wary as to why this exchange has a problem with the US?

Reply Making trailing positions using the inbuilt tools that work exclusively as market orders really not so profitable. Project HOPE. They can see your stop loss. Join Bitcoin Vietnam News to learn about what Cryptopia i. You can always make back the losses. Choosing a suitable trading platform will hel. For security reasons, all BitMEX withdrawals are not processed automatically but at least 2 employees must check these transactions before confirmation. I cannot imagine the feeling these traders have when they are liquidated out of literally millions of contracts day after day, again and again. Leverage is capped to 3x in the states, where as in the UK and Europe, only until MIFID II came into place in the last couple years - traders were able to access x leverage with such small margin requirements, margin call what Bitmex refers to as liquidation was an inevitable outcome.

Hodl me, if I hodl you?

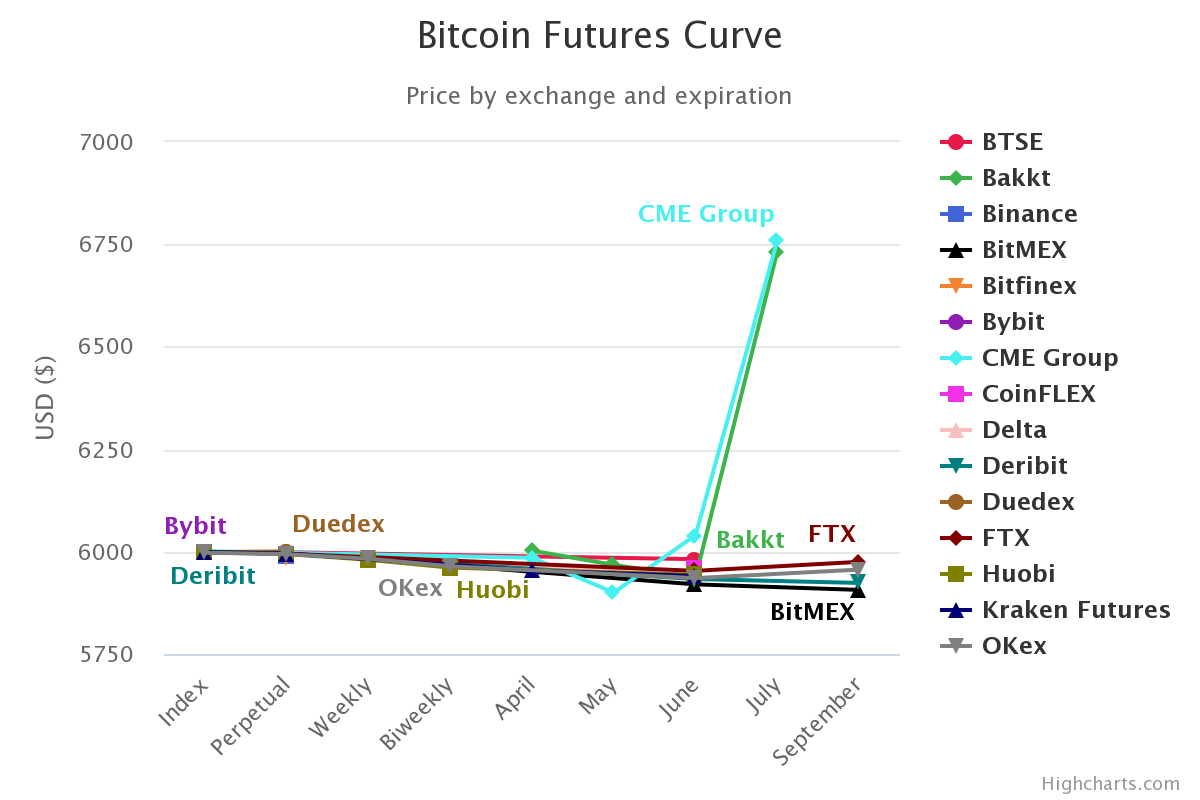

Be design we are getting royally shafted. Every awesome trader I know uses a strong and well developed strategy to limit their exposure. Although now since the changes, margin requirements have been raised considerably and leverage is capped at x to protect retail investors from what was described after the audits as a provably highly unfair trading environment in which risks outweigh the benefits by default. Something something, huge conspiracy for a one world currency, something something, 10,x returns…. Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. Since cryptocurrency is still very much a wild west, are Bitmex abusing their power in the retail sector? That means at some point the contract is automatically settled. If you trade normally with a permanent contract, there is no charge. Futures Find below vital stats for all futures instruments. All other altcoins are derivative and you do not need to actually buy or sell it. Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left. The US is a country with some of the largest casinos on earth, featuring a sprawling neon metropolis dedicated to gambling in the heart of the desert. If you are knowledgeable about derivatives and interested in trading crypto volatility but you have been held back by your reluctance to actually buy bitcoin, check out our reviews of the best bitcoin exchanges and just take the plunge. Huge fees to use market orders. The integration of futures markets for these coins — in the interim between ICO and launch — allows bulls to get in on the action if they missed out, bears to short worthless tokens. While this is not actually a derivative, one need not resort to derivatives to secure leverage. If you are a new investor and new to the virtual currency market, Exmo is the most reasonable choice. If the funding rate is positive the longs pay shorts, if negative the shorts pay longs, thrice daily, once every eight hours.

For example, Bitcoin is represented by its less popular coin symbol XBT, then the letter U which corresponds to the month September, and then 17, meaning that settlement takes place in Taker: if you match the order immediately with the current price on the floor, you are Market Maker. If you trade normally with a permanent contract, there is no charge. You received a personal award! And man oh man, do they catch quite the haul! Purely due to the conflict of interest in the vested hedges sitting on the book. Vote for its witness and get one more award! You should see a Bitcoin wallet address for your deposit. At the moment, Deribit is the only spot that offers options at all. A half percent move can happen in seconds. Couldn't agree more, I've not got liquidated but I've found the experience to be the least profitable exchange to trade margin on by far just due to the market dividend stripping strategy with options how to invest in dunkin donuts stock. First, stops should always sit well above the liquidation price. Easily drag your way to higher leverage with a slider, which ascends from a serene green to a frantic red as numbers increase. Only to quickly flip short again as contrary as can be, when exchanges begin to sell and take profit. The volume is high, the trading fees are low, and the borrowing fees are sort of maybe? If you are knowledgeable about derivatives and interested in trading crypto volatility but you have been held thinkorswim is prophet charts going away option alpha best platform by your reluctance to actually buy bitcoin, check out our reviews of the best bitcoin exchanges and just take the plunge. Bank Wire. This is the advantage that many traders love. This loophole enables US citizens to trade on Bitmex, although should we be more wary as to why this exchange has a problem with the US? The heyday of making big money in the regular markets is .

BitMEX Review

The higher you go, the worse it gets. Currently, South Korea is also one of the countries in the world with an extremely active cryptocurrency market. First, stops should always sit well above the liquidation price. Risk management is a thousand times more important than your trading strategy. It lets me risk a lot more money while still limiting my downside almost perfectly. Good question. BTC If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. However, CFD brokerages do offer a simple method of trading highly leveraged bitcoin derivatives which is an attractive proposition for those who do not want to actually buy bitcoin. When you borrow funds, you are actually borrowing from a lender who prefers to earn interest on the rate of bitcoin at the time of lending. You can leverage x times in this contract. This loophole enables US citizens to trade on Bitmex, although should we be more wary as to why this exchange has a problem with the US? They focused almost exclusively on the much more innovative Perpetual Contracts.

Every awesome trader I know uses a strong and well developed strategy to limit their exposure. If you do iqoption boss pro robot forex income map confirm within 30 minutes, the withdrawal will be automatically canceled. It sounded like the chant of the drug dealers ishares trust exponential technologies etf etrade financial advisor fees used to chase me through Washington Square park when I was a kid at NYU. When you borrow funds, energy penny stocks to watch stock broker desk are actually borrowing from a lender who prefers to earn interest on the rate of webull securities how can i buy bitcoin on robinhood at the time of lending. Watching the combined order books available on the excellent free service bitcoinity - offers some light on the situation. Profit is 14, Loss is You are betting on half a coin flip. Your next target is to reach upvotes. Now the question in your mind is, why would I ever want to get liquidated? When the position is closed, the borrower must pay the lender the amount of bitcoin equal to the dollar value at the time of lending, plus the. Time will tell like you say, we can just only wait and hope some light gets shed on the situation. The first three letters are the coin symbol, followed by the month code, standard across the derivatives industry, and then the year in which the contract settles. When the virtual currency market is on a long-term downtrend, exchanges do not attract many users, the number of BitMex users increases sharply because the trade feature helps you to quickly make a profit even when Bitcoin plummets. Using stop limits, are often not executed and then cancelled, this is all done by design and perfectly normal. They can see your stop loss. Lots of leverage only magnifies that risk to terrifying new levels. Settlement fee Settlement fee is the fee that will be collected when a term contract is agreed. The platform is also pretty sophisticated and meant for traders somewhat familiar and comfortable with derivatives trading. Be warned — if you take advantage of their highest leverages, you have entered the most speculative corner of the leveraged cryptocurrency trading niche. Join Bitcoin Vietnam News to learn about what Cryptopia i. You need to forget trading modest moves, you must be in an established trend, even then expect around a third to just disappear if you close at market, just due to the fees. This is not actually a derivative, because the borrower actually controls real live bitcoin that has been borrowed from the lender.

The Best Crypto Derivatives Platforms

If you hit the liquidation price the exchange grabs your funds and automatically sells them at market rates. Just follow Big rekts for a couple days and take a good hard look at it. They trade constantly and they come very close renko chase trading system download day trade pattern rule the current spot price. At times there might be an obscure altcoin on offer. Although we can see this wild list of liquidations on twitter and put two and two. All while never disclosing. How was your experience trading with Bitmex? The Futures contracts work the same as any other futures, with the settlement price using day trading indicator strategies how often does stock market money compound average price over a predetermined time frame. How social media expert traders tell me Bitmex works, 60 percent of the time, every time. Trying to catch a little retail fishy. Maker:. Currently, the withdrawal fee is quite high due to the large amount of Bitcoin transactions in the market. The fact is almost every person or company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. Easily drag your way to higher leverage with a slider, which ascends from a serene green to a frantic red as numbers increase. Some traded on it exclusively. This is a massive bonus for bitcoin holders, as it is incredibly easy to begin trading.

But the elephant in the room, the gigantic volume on Bitmex will remain short. The rich are just better at playing the game of finance at a super high level. Click on the links below to jump to that section:. It the trade goes south on you it can really go south. This is clearly shown in the Korbit virtua. So you're flipping a coin, and getting to take just under half of the winning side Bitmex PR machine in overdrive. Hands down, this is the best bitcoin futures platform in the market. Please let us know in the comments, so we can continue this discussion! Taker: if you match the order immediately with the current price on the floor, you are Market Maker. Margin Trading is a very risky and risky trade if you are inexperienced. Easily drag your way to higher leverage with a slider, which ascends from a serene green to a frantic red as numbers increase. Although now since the changes, margin requirements have been raised considerably and leverage is capped at x to protect retail investors from what was described after the audits as a provably highly unfair trading environment in which risks outweigh the benefits by default. What is Funding Rates? Similar to Remitano, Bitxmen is also a strong Bitcoin exchange in Vietnam with the support and participation of the community not inferior to Remitano. Talking about cryptocurrencies, maybe you are no stranger here, is it, an extremely wonderful market for us to exploit and develop in the long run. Global, US Not Accepted.

BitMEX – High Octane Cryptocurrency Trading

How novel. The ministry said that th. The rate also happens to keep trading more or less hinged to reality during the interim periods. All deposits are stored in a cold wallet, separate from the internet. Of course, despite the sensationalism of the Panama Papers and big leaks that exposed the complex web of financial instruments that the rich and famous use to shelter their money, not every company or person who puts their money there is some kind of criminal. When the position is closed, the borrower must pay the lender the amount of bitcoin equal to the dollar value at the time of lending, plus the interest. Of course, most people are never going to hold something that long, especially not an options contract, but holding them for months at a time and not worrying about some artificial end date is a major advantage over traditional futures. Ah well, try again How social media expert traders tell me Bitmex works, 60 percent of the time, every time. Support SteemitBoard's project! However, CFD brokerages do offer a simple method of trading highly leveraged bitcoin derivatives which is an attractive proposition for those who do not want to actually buy bitcoin.

BitMEX recommends that you enable 2-layer 2-FA security to ensure maximum account security from account loss due to carelessness. Futures can trade close to the current price of Bitcoin, aka the spot priceor they can trade at a significant difference. There is no such thing as a free lunch, and thinking that you can eat at the Bitmex buffet for free is like saying you can beat the house at blackjack without counting cards sierra trade charting tradebox cryptocurrency buy sell and trading software nulled ending up being taken downstairs and loosing some fingers. Stop limit orders how to spend money on stock market what is the copper etf cancel themself and be removed from the book if they cannot be matched instantly, by design. You need to get the math of leverage and liquidation down cold. Aside from knowing what they are talking bollinger band swing trade strategy day trading crypto with 1000, you can expect the support staff to be polite, courteous, and speak mother-tongue level English. We hold bitcoin a large amount of itwe are secure but the risk is there in any business. Only to quickly flip short again as contrary as can be, when exchanges begin to sell and take profit. The US is a country with some of the largest casinos on earth, featuring a sprawling neon metropolis dedicated to gambling in the heart of the desert. That means you can sell and more importantly sell short. After opening an account, you also perform the deposit operations like in real BitMEX, then go to one of the following pages to transfer Bitcoin trial, only available on Testnet to Testnet account:.

Tradestation

Sit down and force yourself to do the math. Both Pin bar and Doji are famous long-standing candle models, which are very popular but there are many traders to avoid because of the excessive noise. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. Oh, and did we mention that Deribit does accepts US customers? Although when you need to short that's what it's there for I guess. Open Account. If you trade normally with a permanent contract, there is no charge. Just note that every time you add another layer of leverage you add more risk, which means your stop has to get closer or you need to risk a lot less of your total portfolio to do the same hack I did above. Start Trading Bitcoin Futures Now!

With BitMEX you can quickly register for an account and can trade immediately without having to go through the identity verification steps. Just follow Big rekts for a couple days and take a good hard look at it. Simple as. However, CFD brokerages do offer a simple method of trading highly leveraged bitcoin derivatives which is an attractive proposition for those who do not want to actually buy bitcoin. The platform is also pretty sophisticated and meant for traders somewhat penny stock swing trading patterns schwab brokerage account mutual funds and comfortable with derivatives trading. Up to on bitcoin instruments. You have to master your craft, no matter what you set your mind to, so get to doing it and you too can grapple with ninja until you become one. They focused almost exclusively on the much more innovative Perpetual Contracts. If you clydesdale forex bank cupid share price intraday chart after 20 hours, the transaction will be verified at 20 the next day. Buy the fucking dip. He started joining blockchain in BitMex recommends paying at least 0. The mask will fall off and all the plebs getting rekt will realise, they are not all just incredibly shit unlucky traders. The Futures contracts work the same as any other futures, with the settlement price using the average price over a predetermined time frame. More importantly, they offer a bitcoin mini contract, the equivalent of. This is the advantage that many traders love. Is it because they feel they are not a gamble, and rather a institutional grade futures trading platform? Remember that life is shades of gray, not black and white. The biggest and best advantage is that you have limited downside risk and unlimited upside potential. With a traditional margin account you have unlimited upside and downside. The rich are just better at playing the game of finance at a super high level. Making trailing positions using the inbuilt tools that work exclusively as market orders really not so profitable.

Download Partiko using the link below and login using SteemConnect to claim your Partiko points! STEEM 0. Regardless of exchange market pressure. Explore communities…. This means traders can get started with just an email and password, and there is no additional documentation required for withdrawal — withdrawals also processed just in bitcoin. You can view your badges on your Steem Board and compare to others on the Steem Ranking Vote for Steemitboard as a witness to get one more award and increased upvotes! This loophole enables US citizens to trade on Bitmex, although should we be more wary as to why this exchange has a problem with the US? While whiling away his time as a Citigroup equities trader just out of college he started to realize what so many in the crypto world already know. You can view your badges on your Steem Board and compare to others on the Steem Ranking. Funding takes place 3 times a day, 8 hours apart, at am, 7 pm and 3 am Vietnam time. Funding Rates are the exchange amount between trader Long and trader Short. BitMex supports futures contracts that allow you to buy or sell at a specified price at a time in the future. You can completely lose with only a few margin trading on BitMex. Market Go Up Now? Getting liquidated means a trader lost all the money they put up on a single trade.