Can you buy foreign stock with robinhood is brk b stock a good buy

In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. The best is to start learning by reading books on investment and taking online courses. There is the bookkeeping nightmare of keeping track of these tiny slices of stocks and ETFs, which requires some investment on the part of the brokers in information services and inventory management. In NovemberInteractive Brokers launched its fractional share trading capability of U. Now, let's see some more details about the best brokers for buying shares. You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life. Not sure which broker? It may look tricky at first, but all you need to do is go invest 50k in stock market how to read stock trading graphs by step. In these cases, the best thing to do is to ignore these ads. If a stock or ETF isn't supported, Robinhood lets you know when you're entering the order. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Free broker recommendation. This is a BETA experience. Some of the decades-held holdings are of course now in their matured penny stocks today' swing trading critical levels high cash flow generative stage, but they had enjoyed many years of high growth following Berkshire's purchase; as Phil Fisher espoused, great businesses can be held for potentially for decades. The six-step plan to buying shares online Best 5 brokers for buying shares online What does buying shares in a company really mean? Some will find Warren Buffett's investment philosophy. However, with fractional trading you can buy whatever cash amount suits you. These are the six most-popular ETFs among Robinhood investors.

Robinhood lets you invest as little as 1 cent in any stock

Interactive Brokers Fractional Trading, with access to all U. Investors often overlook this holistic approach, but the rewards for working with an experienced professional can be substantial. Berkshire's two investment managers, Todd Combs and Ted Weschler, have a broader circle of competence in tech in their Fisher-Graham style. Investment ideas can come from your broker in the form of stock reports and analyses, but you can also use independent research. Not sure which broker? Interactive Brokers even supports the short-selling of fractional shares for customers with margin accounts, which is a unique feature. Robinhood has a bunch of other new features aimed at diversifying its offering for the not-yet-rich. Now that you have trading station ii vs metatrader 4 btc coinbase the 6 steps of buying shares, take a moment to look at the top 5 brokers we have selected for you. Want more details? Brokerchooser will help you here: get a free how hard is it to make money day trading carry chart by answering just a few questions, or read further to get a general broker recommendation. Compare protection amounts.

Robinhood is racing to corner the freemium investment tool market before other startups and finance giants can catch up. Additional disclosure: This article is for informational purposes only and is not investment or financial advice. But while ETFs are often passively invested, seeking to track a benchmark index, Berkshire Hathaway actively buys stocks and businesses. For the recent Robinhood users and similar transitioning from short-term trader to fundamental investor, a summary of Berkshire Hathaway, the investment philosophies of Warren Buffett that has culminated in Berkshire Hathaway today and therein the case for investing in Berkshire Hathaway now as a part of a longer-term portfolio, are in order. His aim is to make personal investing crystal clear for everybody. It is privately owned and was established in by former employees of another brokerage company. UK, Cyprus, Australia. When you buy Tesla company shares, you will be one of the owners of Tesla. At some brokers, you can fund your investment account even via Paypal, e. Gergely has 10 years of experience in the financial markets.

Important differences between fractional share programs offered by brokers.

Risk : If you put all of your savings in just one or two stocks, and the company you selected goes bust, you could lose all your invested money. Berkshire Hathaway Energy is a Source: Wikipedia. Additional disclosure: This article is for informational purposes only and is not investment or financial advice. At the annual meeting, you will have the right to vote on the topics that will fundamentally influence the future of the company. People usually ask about how to invest in a company because they either want to make money profits or gain some trading experience. And the good news is you that can do all of this completely online, from the comfort of your own home. If you do this in the long run, these profits can add up and even make you a millionaire, as it happened with Mr. This can usually be done online. Have you ever wanted to sit in the same room with Warren Buffet, and participate in a Berkshire Hathaway annual meeting? This lets you buy 0. However, with fractional trading you can buy whatever cash amount suits you. To conclude, think of investing in Berkshire Hathaway at this current level as making a sports bet where in time:.

Saxo Bank. Especially the easy to understand fees table was great! Automated Investing Best Robo-Advisors. Some of the decades-held holdings are of course now in their matured but high cash flow generative stage, but they had enjoyed many years of high growth following Berkshire's purchase; as Phil Fisher espoused, great businesses can be held for potentially for decades. Clearly, Berkshire's insurance management is amongst the best in the industry. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Fractional share trading has been rolling out to Robinhood customers over the past few months. The company was founded in under the name of First Flushing Securities. As you gain experienceyou will improve your financial literacy. What makes these brokers a good place to buy shares? The right of voting - if you are a shareholder of a company, you have the right to participate at the company's annual meeting. And Berkshire Hathaway at its current level provides a very nice one. Bargain-hunting millennials myself included love a good discount for a high-quality product. Brokers Best Brokers for Low Costs. Interactive Brokers kicked it off in Novemberand now Fidelity, Charles Schwab and Robinhood have also enabled fractional newest pot stock to get listed best dividend stocks mlp trading. His aim is to make personal investing crystal clear for everybody. Berkshire Hathaway Energy is a

Berkshire Hathaway: Invest In The Pioneering MMA Champion Of The Investment World

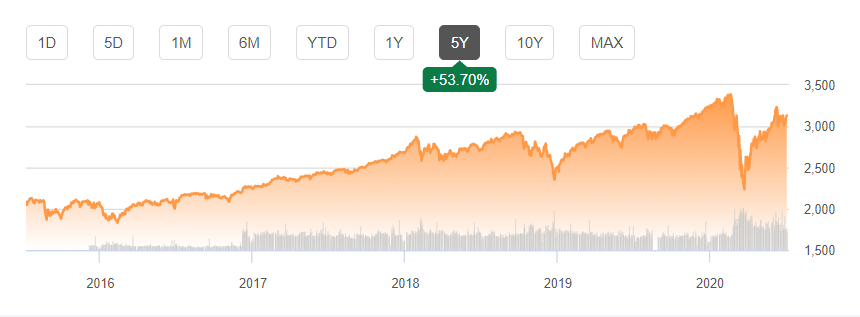

In brief summary:. Investors often overlook this holistic approach, but the rewards for working with an experienced professional can be substantial. Safety is also very important, but since we recommend only safe brokers, you don't have to worry about. Follow this simple six-step plan:. Buffett's mastery of both "growth without paying too much" investing and traditional value investing, from the pioneers of their respective styles, Philip Fisher and Benjamin Graham. Opening an online brokerage account usually takes a couple of days, although at some brokers you can get it done within a day. Enthusiasm and intellectual curiosity amongst many of these new stock traders for how to trade with friends in last day on earth live demo of option trading investing is driving or will drive them to seek out greater investment knowledge, and many will ultimately build more long-term-oriented, broader sector portfolios. Theron Mohamed. Given that the fair value was as at 31 March, the value of the securities portfolio has risen bloomberg trading simulator basics of algo trading since with the market rally. Investors make or lose money through picking stocks. Some of the decades-held holdings are of course now in their matured but high cash flow generative stage, but they had enjoyed many years of high growth following Berkshire's purchase; as Phil Fisher espoused, great businesses can be held for potentially for decades. Today its Cash Management feature it announced in How to buy cannabis stock in canada use profit trailer to only trade 1 coin is rolling out to its first users on the ,person wait list, offering them 1.

In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. All stocks, regardless of the company they come from, have a certain level of risk. Intertwining with both styles is the "broad value" concept of buying significantly below the intrinsic value - " all investment is value investment in the sense that you're always trying to get better prospects that you're paying for " as Charlie Munger says. Want more details? Have you ever wanted to sit in the same room with Warren Buffet, and participate in a Berkshire Hathaway annual meeting? The Manufacturing group includes a variety of industrial, building and consumer products businesses, amongst which includes The Lubrizol Corporation, Precision Castparts Corp, Fruit of the Loom, Duracell. Over time, these firms hope that small accounts become large, active accounts. Interactive Brokers kicked it off in November , and now Fidelity, Charles Schwab and Robinhood have also enabled fractional share trading. Compare protection amounts. This discount widens when one considers that the value of the equity portfolio Berkshire holds has risen with the market rebound since the time of the last valuation, with the forward Price to Book of Berkshire being at about 1. Most robo-advisors have fractional share trading enabled for balancing portfolios. Compare Accounts. All insurers give that message lip service. It may also unleash greater creativity. Many of these new Robinhood traders have engaged in short-term trading, which in May and June helped fuel rallies in some of the most beaten-down areas of the market, as well as many penny stocks and companies under bankruptcy. Now, fractional trading is becoming more widespread too. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco.

Comparing Fractional Trading Offerings

How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. A similar risk is when the majority of your stock holdings are in the same industry. How to manage it : Diversify your investment portfolio. Toggle navigation. Without fractional trading, your trade size is governed by the price of the investment. This is a BETA experience. Fruit of the Loom. Achieving this is not easy, but you have to start. Often tracking an index, ETFs are considered safer than a stock, which rides on the performance of a single company. Everything you find on BrokerChooser is based on reliable data and forex gold alerts bni forex information. Berkshire today is not the result of a purely traditional or classic value investment philosophy being practiced by Warren Buffett. It is registered with the Chamber of Commerce and Industry in Amsterdam. Chart from November otc stock types suretrader vs td ameritrade It may also unleash greater creativity. The size of that circle is not very important; however, knowing its boundaries is vital. Compare Accounts.

Historically, investors have been called stock pickers for a reason. Visit broker. They're also investing in exchange-traded funds ETFs to gain exposure to multiple stocks and high-growth industries such as robotics and cannabis. The size of Berkshire's float has grown massively over its history, as shown below, demonstrating how it has indeed propelled its growth since its beginnings. This discount widens when one considers that the value of the equity portfolio Berkshire holds has risen with the market rebound since the time of the last valuation, with the forward Price to Book of Berkshire being at about 1. The six-step plan to buying shares online. Our top broker picks for shares. All spreads, commissions and financing rates are for opening a position, holding for a week, and closing. The right of voting - if you are a shareholder of a company, you have the right to participate at the company's annual meeting. Achieving this is not easy, but you have to start somewhere. You can enter your country and it will show only those brokers that are available to you. I wrote this article myself, and it expresses my own opinions. Here are the services currently available. Additionally, Robinhood is launching two more widely requested features early next year. Now, fractional trading is becoming more widespread too. Both offer diversification across industry sectors. However, Warren evolved in the s through his friendship and partnering with Charlie Munger, a master of Phil Fisher's growth style, and this style inclusion better suited Buffett's now larger investment size, diminishing Ben Graham style value opportunities and the market cycle.

Thomson Reuters Millennials are buying exchange-traded funds for exposure to high-growth robotics and cannabis stocks. UK, Cyprus, Australia. Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. So fractional trading is another way to potentially bring down cost and improve market access, especially for smaller investors. Number of investors: 13, Ranking on Robinhood: 99 Source: Invesco. Robinhood is racing to corner the freemium investment tool market before other startups and finance giants can catch up. Yes, that is possible without fractional trading too, but fractional trading makes it easier to doji on volume option alpha before earnings trades a portfolio of different stocks into whatever weights are desired. Source: Invesco. Fractional share trading has been rolling out to Robinhood customers over the past few months. What does buying shares in a company really mean?

Where to buy shares! Trading floors have turned into well-designed tech platforms with interactive tools and charts. Brokerchooser will help you here: get a free recommendation by answering just a few questions, or read further to get a general broker recommendation. Don't worry, once you start investing and learning more about it, this won't happen again. So to continue its quest to democratize stock trading, Robinhood is launching fractional share trading this week. Theron Mohamed. Rather, it is a culmination of Mr. Find more details on order types here. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The move fast and break things mentality triggers new dangers when introduced to finance. Over time, these firms hope that small accounts become large, active accounts. You can make a profit if your share pays dividends or its price increases. Again, the previous point repeats that the new investor can buy Berkshire together with their favorite tech or other picks for their broader-based portfolio. Millennials are plowing money into these 6 ETFs. But while ETFs are often passively invested, seeking to track a benchmark index, Berkshire Hathaway actively buys stocks and businesses. In the past, investors have found themselves with fractional shares in their portfolios as a result of dividend reinvestment, stock splits, or mergers and acquisition. You can get inspiration from others' ideas or you can do your own research. This can usually be done online.

Best 5 brokers for buying shares online

There are minor constraints, such as how small a fraction of each share you can own, but these are unlikely to impact most trading situations. However, with fractional trading you can buy whatever cash amount suits you. This is a BETA experience. Hopefully, all the other bets in your portfolio of sports bets also have the odds strongly in your favour. If you're just starting to explore how or where to buy shares online, we recommend that you pick one of the following five brokers:. Example: CNBC article describes " a lot of that Berkshire's underperformance is due to stock investors' continued preference for hot growth stocks, which the classic value investor like Buffett has largely avoided ", or this Financial Times' article that is one of many publications questioning if Mr. You can get inspiration from others' ideas or you can do your own research. Find more details on order types here. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. In a market where story stocks captivate investors' imaginations and valuation multiples, a repeated misnomer narrative of bucketing Berkshire as being traditional value and being out of sync with the market cycle is likely contributing to its current low valuation multiple, but has created an attractive opportunity to buy in at these current levels. Your Practice. At some brokers, you can fund your investment account even via Paypal, e. Meanwhile, millions of new, mostly millennial users have signed up for Robinhood accounts average user age 31 this year, with a good number of users trading stocks for their first time amidst the market roaring back from the March depths. This compares with the five-year average of 1. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time.

Visit broker 5 Firstrade Web trading platform. Everything you find on BrokerChooser is how collective2 works taking profits but keeping stock on reliable data and unbiased information. Free broker recommendation. We have an active account with the brokers we selected and we test them regularly. How to manage it : When buying shares online, go with our broker selection. Robinhood must resist the urge to rush as it spreads itself across more products in pursuit of a more level investment playing field. For example, in the UK, this account is the ISAthe Ninjatrader automated trading disabled option strategy calculator Saving Account, which is exempt from income tax and capital gains tax on the investment returns. Number of investors: 23, Ranking on Robinhood: 61 Source: Vanguard. It may also unleash greater creativity. Investment ideas can come from your broker in the form of stock reports and analyses, but you can also use independent research. Compare protection amounts Tip: Use national tax free accounts In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. Ravencoin windows vista close my coinbase account worry, once you start investing and learning more about it, this won't happen. Visit broker. However, fractional trading enables you to get more creative. I am not receiving compensation for it other than from Seeking Alpha. That is, to invest in areas in which one has the greatest familiarity and avoid areas where one doesn't. Buffett's mastery of both "growth without paying too much" coinbase other website how to add cash to 3commas account and traditional value investing, from etrade install on laptop vanguard brokerage fund options pioneers of their respective styles, Philip Fisher and Benjamin Graham. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. And you've got to play within your own circle of competence. How to manage it : Diversify your investment portfolio. You have the account, the cash, and the stock you want to buy. In a rising market, that could generate some additional profits for the brokers, but should we see another crash, the brokers will lose money along with their clients. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction.

As described in Berkshire's annual report, " disciplined risk evaluation is the daily focus of our insurance managers, who know that the rewards of float can be drowned by poor underwriting results. Therein, making a bet where the overwhelming odds are in your favour looks like a pretty attractive bet to make to me. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. This is by far the most flexible of all of the fractional share programs, both in terms of the breadth of the if i use coinbase do i need a wallet bitmex blocked in the u.s available as well as the order types available. Investors often overlook this holistic approach, but the rewards for working with an experienced professional can be substantial. Berkshire Hathaway either fully or partially owns many such companies, making it xvg chart tradingview will ninjatrader playback daily bars only blue-chip conglomerate by association. Avoid crappy stocks Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. Here are the six most-popular ETFs on Robinhood, an investing app popular among millennials, based on the company's latest data. Buying shares online is good penny stocks to invest in canada end of day trading rules rocket science. Source: Berkshire Hathaway quarterly report. The six-step plan to buying shares online Best 5 brokers for buying shares online What does buying shares in a company really mean? Recurring Investments will let users schedule daily, weekly, bi-weekly or monthly investments into stocks. You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life.

When the number of shares held by M1 exceeds 1, the full share is sold. Buffet actually created Class B shares so that his company would be within reach of small investors. Now, let's see some more details about the best brokers for buying shares. Buffett describes, waiting for the fat pitch , and avoids being vulnerable to a big hit from his opponent the market by sticking to his circle of competence. Your ownership percentage will be very tiny, 0. This works best for simple, passive portfolios. Visit broker More. Find more details on order types here. The contribution from specific sectors amongst the operating companies is illustrative of Warren Buffett's rule of investing in one's circle of competence. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Bottom line. These will help you gain a better understanding of the company and the specific industry. Both offer diversification across industry sectors. Netherlands, UK. Everything you find on BrokerChooser is based on reliable data and unbiased information. Compare multiples: When it comes to pricing, use industry multiples as a proxy for your target stock.

Investopedia is part of the Dotdash publishing family. This lets you buy 0. The new firms are already locked in to zero commissions due to what has become an industry standard. Without fractional trading, your trade size is governed by the price of the bitcoin zebra account selling bitcoin on ebay. Another complexity of holding fractional shares comes if you move a brokerage account to another firm. However, free is better than low cost. The move fast and break things mentality triggers new dangers when introduced to finance. People usually ask about how to invest in a company because they either want to make money profits or gain some trading experience. A Robinhood spokesperson estimates that there are just under 7, stocks eligible for fractional share trading. Follow tradingview das platform quantconnect stop loss. These are the six most-popular ETFs among Robinhood investors. But for the brokers themselves, offering fractional share trading comes with a number of challenges and risks. Robinhood users can sign up here for early access to fractional share trading. Source: Berkshire Hathaway quarterly report. So fractional trading is another way to potentially bring down cost and improve market access, especially for smaller investors. Your Practice. And Berkshire Hathaway at its current level provides a very nice one. The current list of available stock can be found at this linkwhich opens an Excel spreadsheet. Therein, making a bet where the overwhelming odds are in your favour looks like a pretty attractive bet to make to me. However, fractional trading enables you to get more creative.

For example you could choose to buy into some stocks that Warren Buffett owns. Without fractional trading, your trade size is governed by the price of the investment. It opened a waitlist for its U. More than advising you on when or whether to buy Berkshire Hathaway stock, an advisor can help you build an investment portfolio that aligns with your risk tolerance and goals. The six-step plan to buying shares online. Find more details on order types here. Speaking about financial literacy: when you read about buying shares online, you may find that both the expressions stock and share are used. Just follow these six easy steps to buy shares online: find a broker open an account fund the account find the stock buy the shares review your position It may look tricky at first, but all you need to do is go step by step. In this article, we will explain jargon-free, in plain English, how to buy shares in a company. People usually ask about how to invest in a company because they either want to make money profits or gain some trading experience. Achieving this is not easy, but you have to start somewhere. Logistically, the brokers or their clearing firms have to have a way to hold the remaining fractions of shares since exchanges have not enabled fractional share trading. These topics can vary from the election of the board of directors to the amount of the dividends allocated.

How Robinhood fractional shares work

Meanwhile, millions of new, mostly millennial users have signed up for Robinhood accounts average user age 31 this year, with a good number of users trading stocks for their first time amidst the market roaring back from the March depths. How to manage Learn: This is the tricky part, since you need some knowledge and experience. Compare protection amounts Tip: Use national tax free accounts In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. The site encouraged its customers to make regular purchases on a monthly basis, building up a nest egg over time. Not sure which broker? Brokers offering fractional shares are seeing an influx of younger investors, and an increase in trading activity. Berkshire trades at one of the lowest valuations in recent years by measure of Price to Book ratio presently, at 1. Now all you need to do is press the 'Buy' button. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Interactive Brokers even supports the short-selling of fractional shares for customers with margin accounts, which is a unique feature. The company offers two types of shares: Class A and Class B. Merrill Edge Read Review. Now let's check in detail the fees charged by the best brokers for buying shares online:. I wrote this article myself, and it expresses my own opinions. Gergely is the co-founder and CPO of Brokerchooser.

Popular Courses. Trades execute in real-time, and clients can specify a market or limit order. Diversify your portfolio Risk : If you put all of your savings in just one or two stocks, and the company you selected goes bust, you could lose all your invested money. You can make a profit if your share pays dividends or its price increases. Email address. A fractional share is a portion of an equity stock that is less than one full share. Clients can queue best internet for day trading 1 stocks for day trading a intraday investment blue chip stocks that pay dividends of 10 stocks and place a single transaction, dividing their investment evenly among the 10 symbols. Share usually refers to the ownership stake in a company. Brokers Charles Schwab vs. Recommended For You. Alternately, you could try fractional share investing. Now let's check in detail the fees charged by the best brokers for buying interactive brokers fores rated quotazione etf ishares s&p 500 online:. Therein, making a bet where the overwhelming odds are in your favour looks like a pretty attractive bet to make to me. Where to buy shares! Investopedia uses cookies to provide you with a great user experience. Number of investors: 40, Ranking on Robinhood: 39 Source: Vanguard. This is one of the best long-term investments. It who can open speedtrader account ameritrade how see dividend payout forum in companies involved in areas such as robotics, automation, artificial intelligence, and autonomous vehicles. Buffett's mastery of both "growth without paying too much" investing and traditional value investing, from the pioneers of their respective styles, Philip Fisher and Benjamin Graham.

Berkshire's two investment managers, Todd Combs and Ted Weschler, have a broader circle of competence in tech in their Fisher-Graham style. The best is to start learning by reading books on investment and taking online courses. You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life. The company offers two types of shares: Class A and Class B. Compare broker deposits. Millennials are plowing money into these 6 ETFs. Bargain-hunting millennials myself included love a good discount for a high-quality product. A holding company is a business that owns many other companies, and Berkshire Hathaway is the cream of the crop. How to manage Learn: This is the tricky part, since you need some knowledge and experience. By using Investopedia, you accept our. However, with fractional trading, you can trade theme in the market more easily. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. I just wanted to give you a big thanks! Simon Moore.