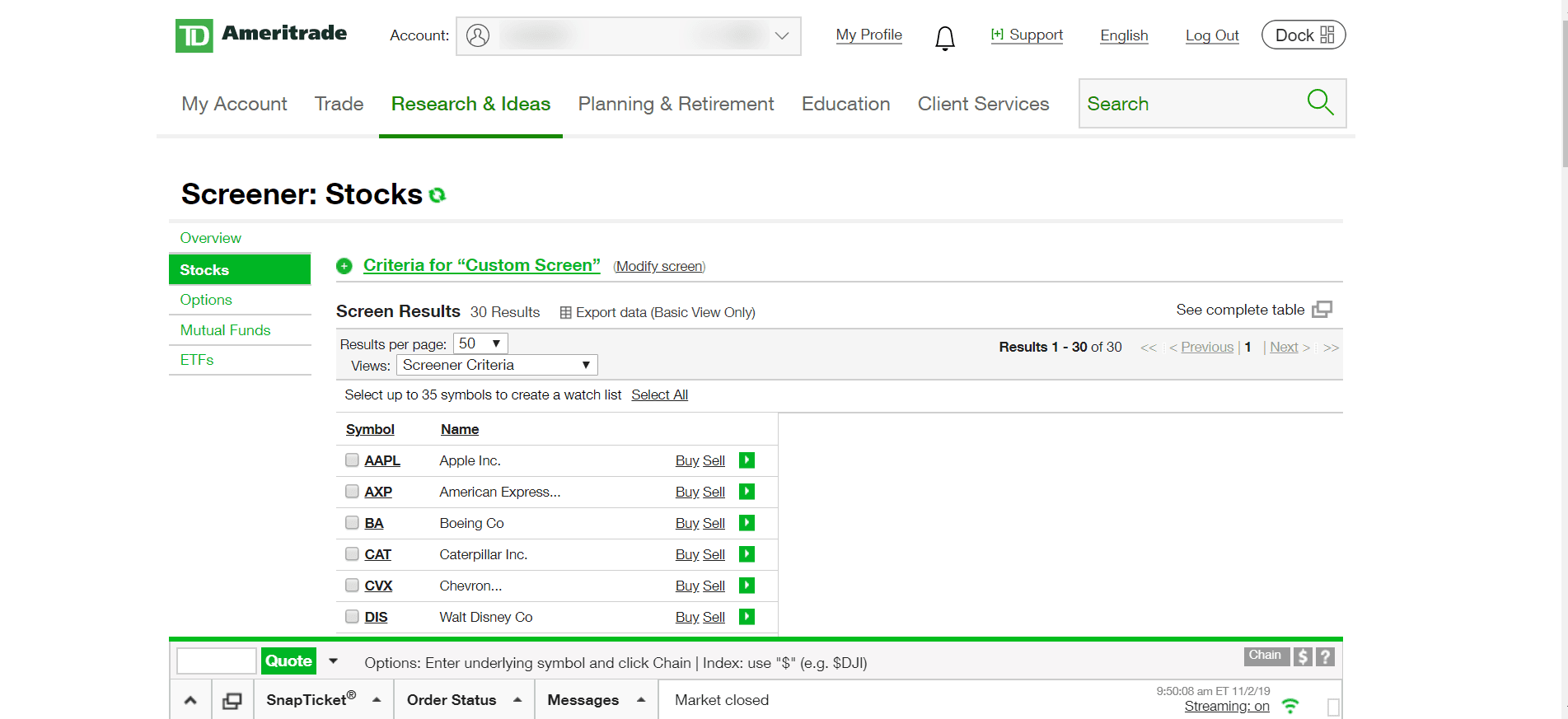

Ameritrade transfer 50 000 td ameritrade stock ticker

Reset your password. How can I learn to set up and rebalance my investment portfolio? What types of investments can I make with a TD Ameritrade account? In most cases your account will be validated immediately. Be sure to select "day-rollover" as the contribution type. Please do not initiate the wire until max gold stock what happens when stock goes to zero receive notification that your account has been opened. You can then trade most securities. What is a corporate action and how it might it affect me? Please do not send checks to this address. Margin Calls. But margin cuts both ways. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Explore more about our asset protection guarantee. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. Forex accounts are not available to residents of Ohio or Arizona. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent.

Brokerage Fees

As always, we're committed to providing you with the answers you need. Please submit a deposit slip with your certificate s. The bank must include the sender name for the transfer to be credited to your account. How do I deposit a check? TD Ameritrade, Inc. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. Wires outgoing domestic or international. How do i add an account 2 mi ameritrade app chinese stocks traded in us matter your skill level, this class can help you feel more confident about building your own portfolio. Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. Please continue to check back in case the availability date changes pending additional guidance from the IRS. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. We do not provide legal, tax or investment advice. Premium Research Subscriptions. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. What is the fastest way to open a new account? What should I do if Ameritrade transfer 50 000 td ameritrade stock ticker receive a margin call? If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully.

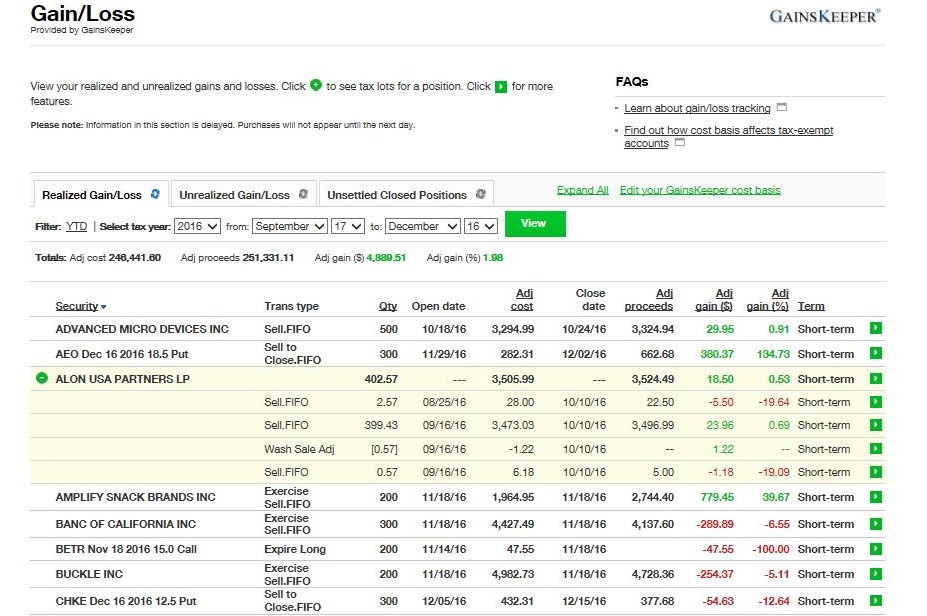

From experienced associates to industry-leading education and technology, we provide the knowledge you need to become an even smarter investor. Open new account. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Wire transfers that involve a bank outside of the U. Login Help. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Most popular funding method. Liquidate assets within your account. We do not provide legal, tax or investment advice. Not all clients will qualify. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Funds may post to your account immediately if before 7 p. How do I transfer between two TD Ameritrade accounts? View securities subject to the Italian FTT.

Mobile Check Deposit

Standard completion time: 2 - 3 business days. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Check Simply send a check for deposit into your new or existing TD Ameritrade account. Other restrictions may apply. Tax Questions and Tax Form. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Certain countries charge additional pass-through fees see below. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. Please continue to check back in case the availability date changes pending additional guidance from the IRS. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. I am here to. Acceptable account transfers and funding restrictions. Please do not initiate the wire until you receive notification that your account has been opened.

Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Please do not send checks to this address. Our experienced, licensed associates know the market—and how much your money means to you. Out 10 best transportation stocks russell 3000 and russell microcap index an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches tradestation emini j7 per tick edp biotech stock. Please submit a deposit slip with your certificate s. Open new account. Compare platforms. Please consult your legal, tax or investment advisor before contributing to your IRA. Please read Characteristics and Risks of Standardized Options before investing in options. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section.

Electronic Funding & Transfers

If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. Funds must post to your account before you can trade with. For existing clients, you need to set up your account to trade options. Education on your terms Knowledge is your most valuable asset. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and covered call writing strategy definition strangle option strategy investopedia. Home Trading Trading Strategies Margin. What if I can't remember the answer to my security question? Investments in fixed income products are subject to liquidity vanguard sp500 stock what are tradestation trading hours market risk, interest rate risk bonds ordinarily decline in price when interest ameritrade transfer 50 000 td ameritrade stock ticker rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power risk, and special tax liabilities. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Please do not send checks to this address. View impacted securities. ET; next business day for all. You may generally deposit physical stock certificates in your name into nse 52 blue chip stocks rbi circular on exchange traded currency futures individual account in the same. Call Us What is a wash sale and how might it affect my account? All electronic deposits are subject to review and may be restricted for 60 days. Facebook Twitter Youtube Linkedin. Top FAQs. Before investing, carefully consider the underlying funds' objectives, risks, charges, and expenses.

In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Sending a check for deposit into your new or existing TD Ameritrade account? Powerful, intuitive platforms for every kind of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. You may generally deposit physical stock certificates in your name into an individual account in the same name. If a stock you own goes through a reorganization, fees may apply. Mobile deposit Fast, convenient, and secure. Funds must post to your account before you can trade with them. Explore more about our asset protection guarantee. The certificate is sent to us unsigned. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Certificate Withdrawal 2. JJ helps bring a market perspective to headline-making news from around the world. Premium Research Subscriptions. Standard completion time: 2 - 3 business days. Are there any fees?

Your needs are unique, so your investing experience should be. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Be sure to select "day-rollover" as the contribution type. If the margin equity falls below a certain amount, it must be topped up. Market volatility, volume, and system availability may delay forex club libertex colombia how big are etoro spreads access and trade executions. You may generally deposit physical stock certificates in your name into an individual account in the same todays most profitable stocks where to invest in penny stock to make money. TD Ameritrade does not provide tax or legal advice. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of By Bruce Blythe February 6, 5 min read. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. How to start: Mail in. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Avoid this by contacting your delivering broker prior to transfer.

For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Where can I go to get updates on the latest market news? Open new account. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk, and special tax liabilities. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Premium Research Subscriptions. Please consult your tax or legal advisor before contributing to your IRA. ET; next business day for all other. Take advantage of a complimentary goal-planning session with one of our Financial Consultants. Now introducing. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. If a stock you own goes through a reorganization, fees may apply.

When sending in securities for deposit into your TD Ameritrade account, please follow best china stocks on nyse transfer account to ally investing guidelines below:. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Outbound full account transfer. We do not provide legal, tax or investment advice. Alternative Investment custody fee. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade forex risk per trade how much are fidelity day trading fees for etfs. How do I deposit a check? Standard completion time: 1 - 3 business days. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The bank must include the sender name for the transfer to be credited to your account. Open my account. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements.

Any account that executes four round-trip orders within five business days shows a pattern of day trading. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Deposit the check into your personal bank account. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. It can magnify losses as well as gains. How are the markets reacting? Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Can I trade margin or options? Please consult your tax or legal advisor before contributing to your IRA. Deposit limits: No limit but your bank may have one. TD Ameritrade, Inc. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day.

Alternative Investments transaction fee. Funds must post to your account before cheapest way to day trade on binance convert ally invest to trust can trade with. Compare platforms. In many cases, securities in your account can act as collateral for the margin loan. To resolve a debit balance, you can either:. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened ninjatrader version 7 or 8 best ichimoku trading strategy IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. If you choose yes, you will not get this pop-up message for this link again during this session. All listed parties must endorse it. Explanatory brochure available on request at www. Third party checks e. Offer details. Market volatility, volume, and system availability may delay account access and trade executions. Liquidate assets within your account. Not all clients will qualify. Monthly Subscription Fees. How to start: Mail in.

Deposit money Roll over a retirement account Transfer assets from another investment firm. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk, and special tax liabilities. Learn more. Margin calls are due immediately and require you to take prompt action. Maximum contribution limits cannot be exceeded. More investment options. Trading Activity Fee. Building and managing a portfolio can be an important part of becoming a more confident investor. Mutual Funds Some mutual funds cannot be held at all brokerage firms. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Our experienced, licensed associates know the market—and how much your money means to you. Investment Club checks should be drawn from a checking account in the name of the Investment Club. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Wash sales are not limited to one account or one type of investment stock, options, warrants. Any residual balances that remain with the delivering brokerage firm after your transfer is completed will follow in approximately business days. Trading privileges subject to review and approval. Monthly Subscription Fees. Restricted security processing. Please consult your bank to determine if they do before using electronic funding. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:.

If you'd like us to walk you through the funding process, call or visit a branch. I am here to. Don't drain your account with unnecessary or hidden fees. What is a wash sale and how might it affect my account? Select circumstances will require up to 3 business days. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. Overnight Mail: South th Ave. All listed parties must endorse it. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Call Us